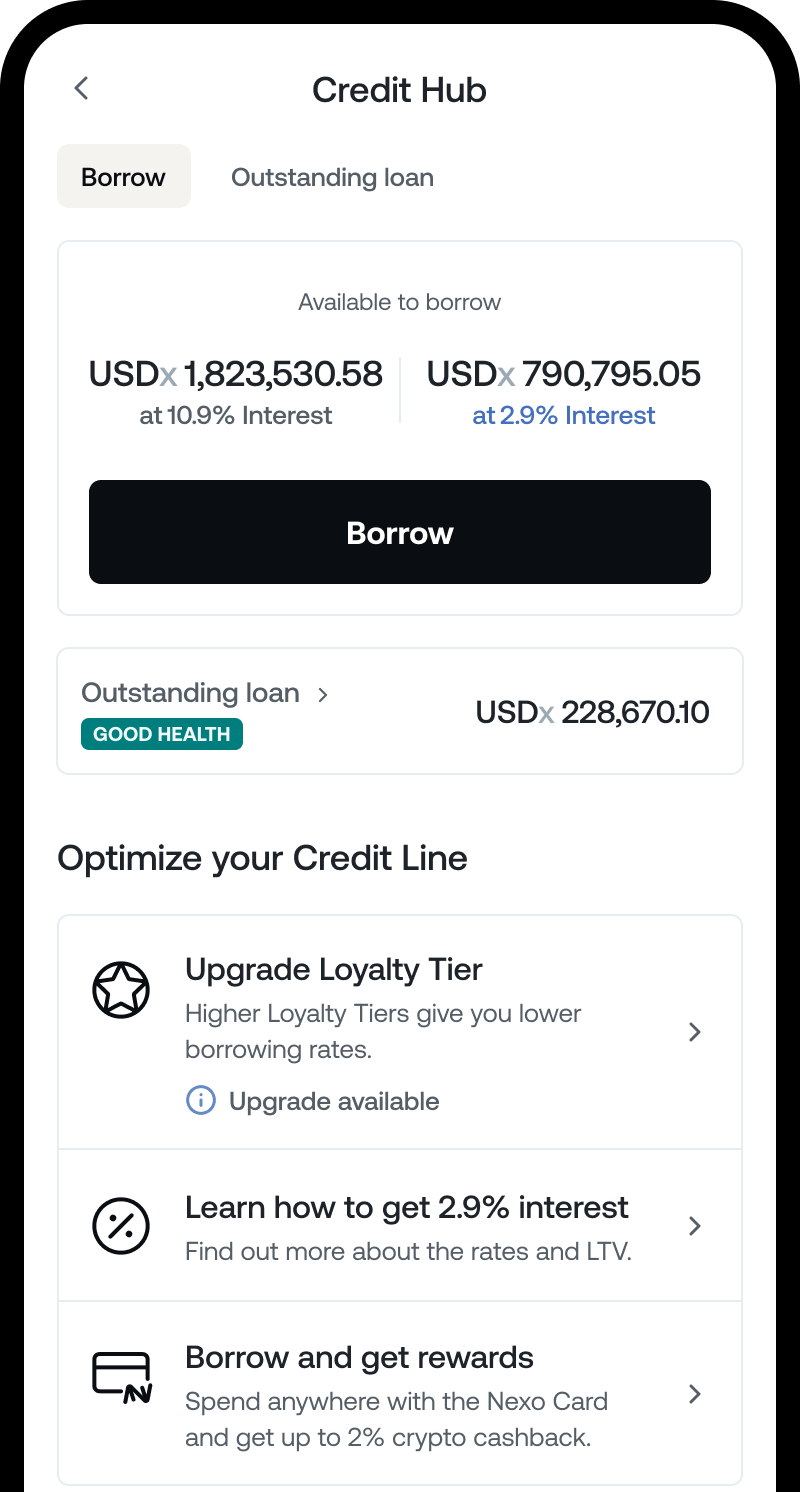

There is no need to sell digital assets to borrow, and the annual interest rate starts from 2.9%.

Operating hours

Since 2018

Personalized client care

Support available 24/7

Asset Management

$110+ billion

Operating hours

Since 2018

Personalized client care

Support available 24/7

Asset Management

$110+ billion

The maximum daily loan limit for general customers is $2 million, and the maximum daily loan limit for private customers is $200 million.

Activate Quick block bs, and the approval process is completed automatically—no credit history required, funds arrive within 24 hours.

Access liquidity while retaining your assets, avoiding taxable events caused by selling.

Choose to receive your loan in your bank account or in stablecoins to your our account.

Repay your Quick block bs at your own pace, without worrying about strict repayment schedules.

Combine multiple assets as collateral and borrow flexibly based on your needs.

Low interest, fast approval, flexible repayment, help you easily solve your funding needs, borrow money without pressure

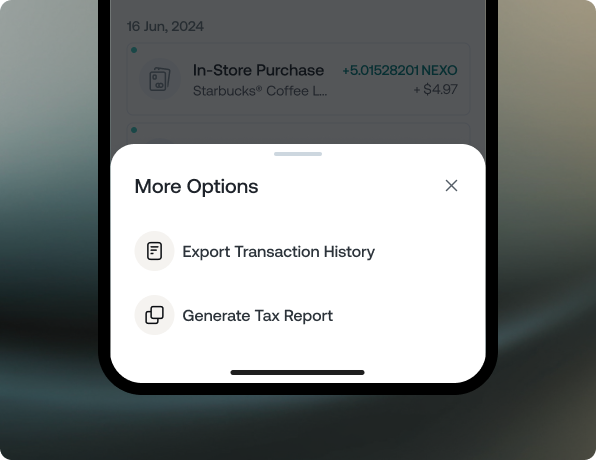

Enjoy crypto cashback of up to 2% on every purchase.

Spend without selling your digital assets.

The more you top up your our account, the higher your borrowing and spending limits.

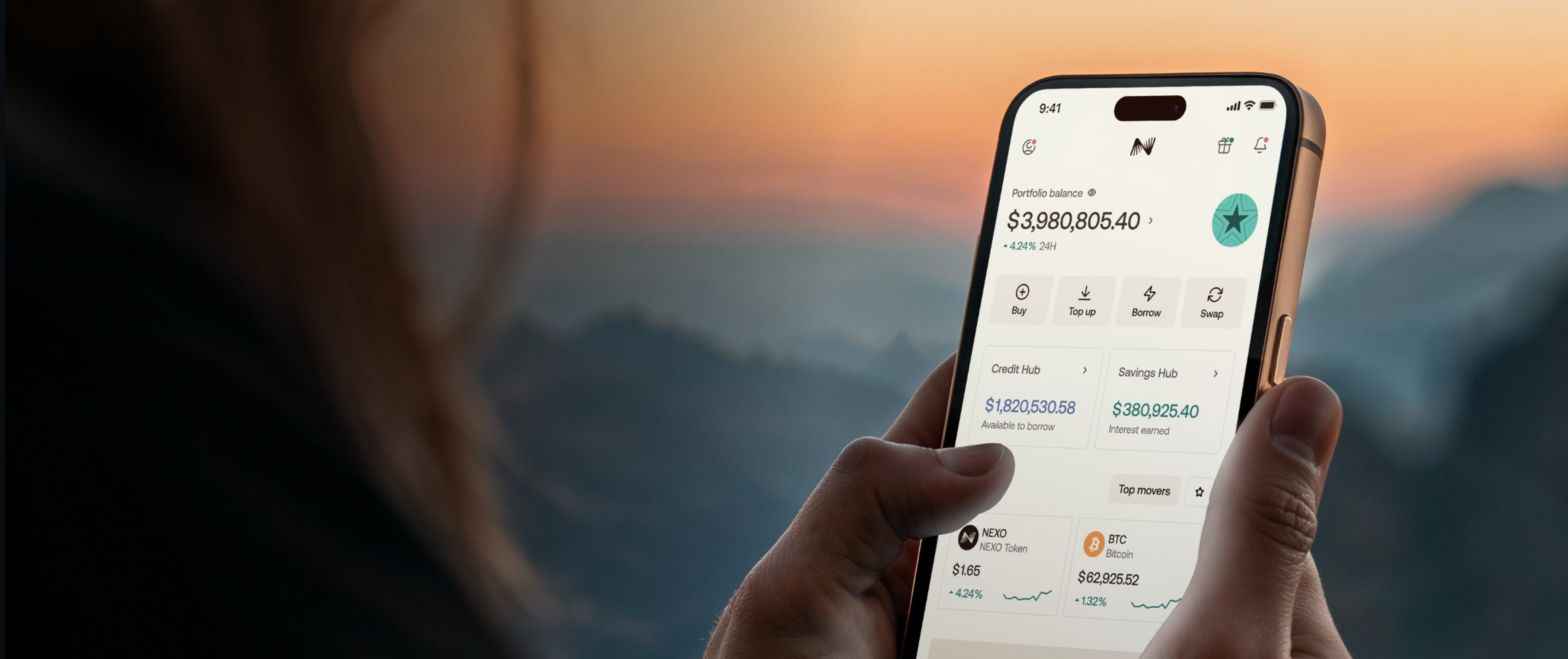

Unlock access to a dedicated account manager, exclusive OTC services, and custom terms and rates with account balances over$100,000.

Unlike traditional loans that rely on credit scores, we offer crypto-backed Quick block bs, using digital assets as collateral. Once you deposit, Quick block bs becomes immediately available. There are two ways to receive funds:

To activate Quick block bs, follow the steps outlined in our Help Center article.

With our crypto-backed loan, you can receive funds the same day or next day. Processing times are:

Interest rates depend on your loyalty tier. Tiers are based on the ratio between the value of our token and the rest of your portfolio, assuming a digital asset balance above $5,000:

If your digital asset balance is under $5,000, the interest rate is 18.9%.

For more on how the loyalty program works, visit our Help Center.

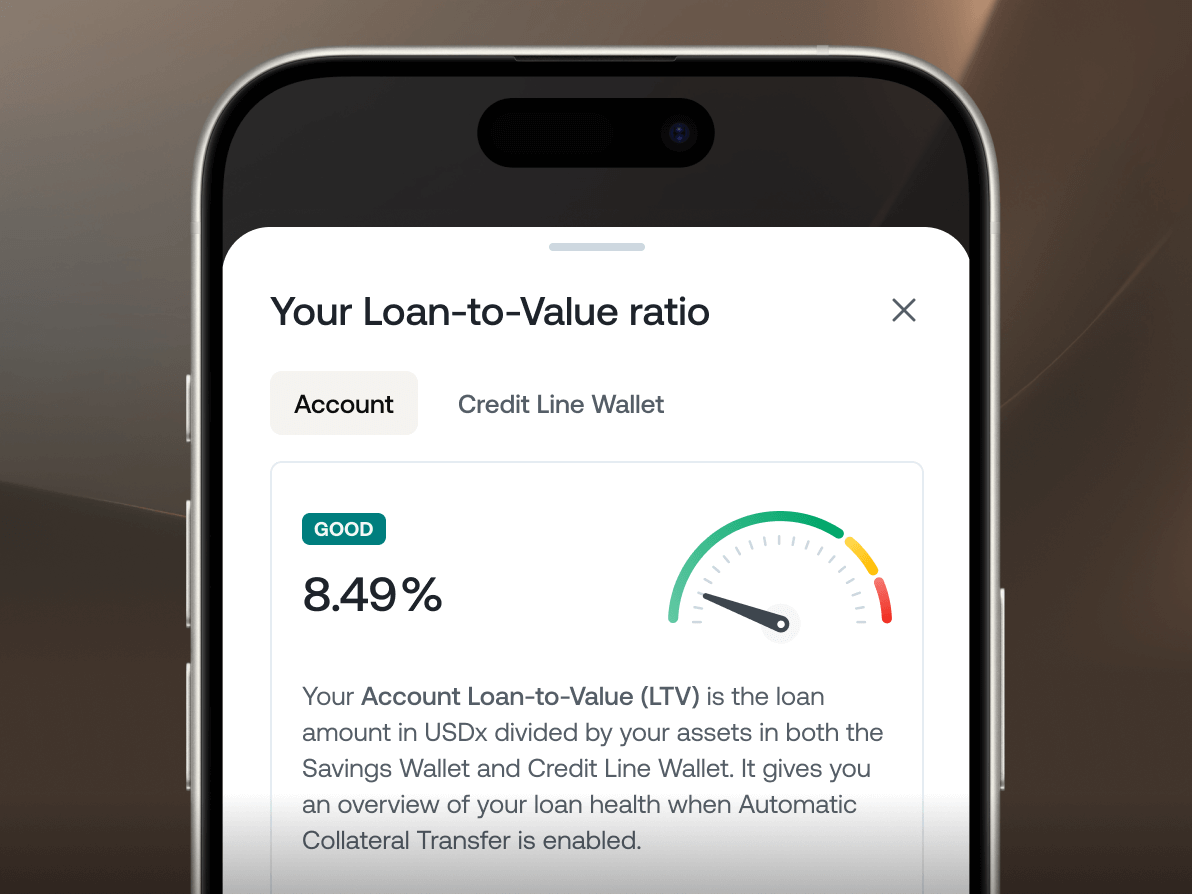

Quick block bs's Loan-to-Value (LTV) determines the crypto collateral required. For specific LTVs per asset, visit our Help Center.

If the collateral value increases, your Quick block bs limit will also increase. You may borrow more, keep your current loan, or repay some of it using the appreciated crypto value.

If the collateral value decreases, the Loan-to-Value (LTV) will rise. If it exceeds 70% and continues to rise, you may receive a margin call via email or push notification.

If LTV hits the critical level, partial auto-repayment may occur to rebalance it. To protect your assets, only the minimum necessary amount will be sold.

For more details, visit our Help Center article.

We are designed for block bschain wealth creation pioneers. Create an account now and start your journey to wealth creation.